GTM Global is known for its work in supporting companies expand internationally, but at a time when we all could do with a few more pounds in our bank accounts, there is one area where we may be missing an opportunity to increase cashflow through the correct and accurate claiming of capital allowances.

We asked Sandy Findlay at ABGi (innovation funding specialists and GTM Partner since 2020) to share some thoughts, facts and figures to help your business maximise capital allowances.

As Sandy explained, failure to recognise and properly account for historical investments, and to accurately categorise the nature of these investments, is costing UK companies thousands of pounds in tax benefit.

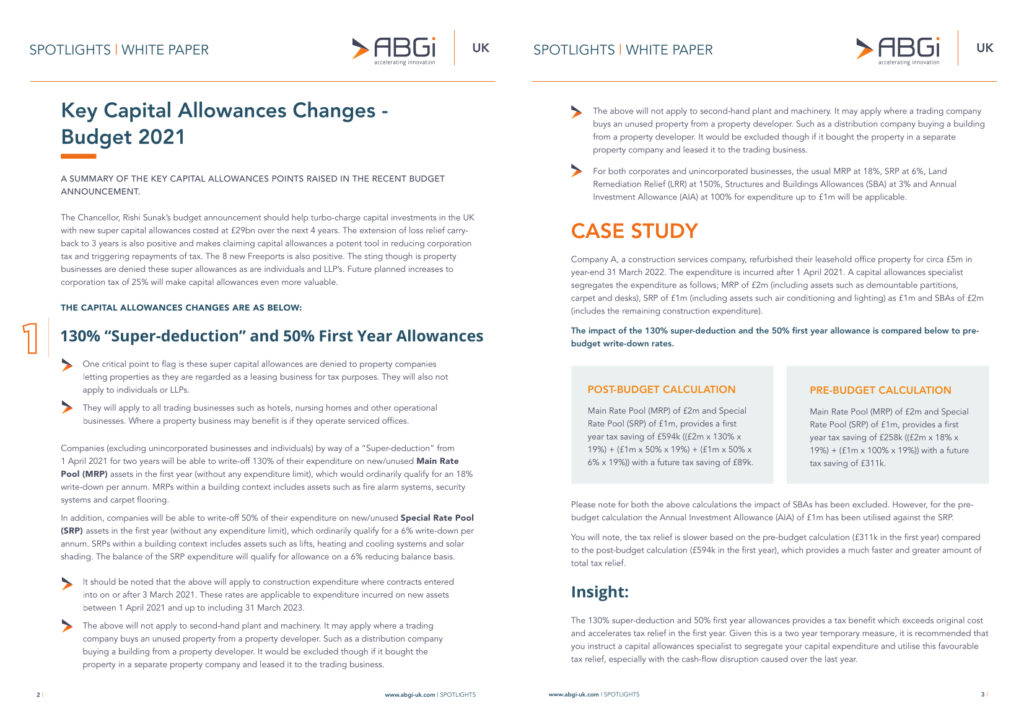

And, with Rishi Sunak introducing a 130% super enhancement for capital allowances and a 3- year loss carry back, at the recent budget, this means that your business could miss out on even more tax benefit.

While there is no doubt that it is your accountant’s responsibility to submit claims for capital allowances, accountants are not generally trained in assessing building costs or comfortable with making assessments where building invoices provide no detail, and as a result risk giving you incorrect advice.

Failure to consult a capital allowances specialist, with appropriate knowledge and experience in extracting the information required to make a compliant capital allowances claim, is resulting in numerous companies missing out on the full value of capital allowances they could be entitled to.

Capital allowances scheme

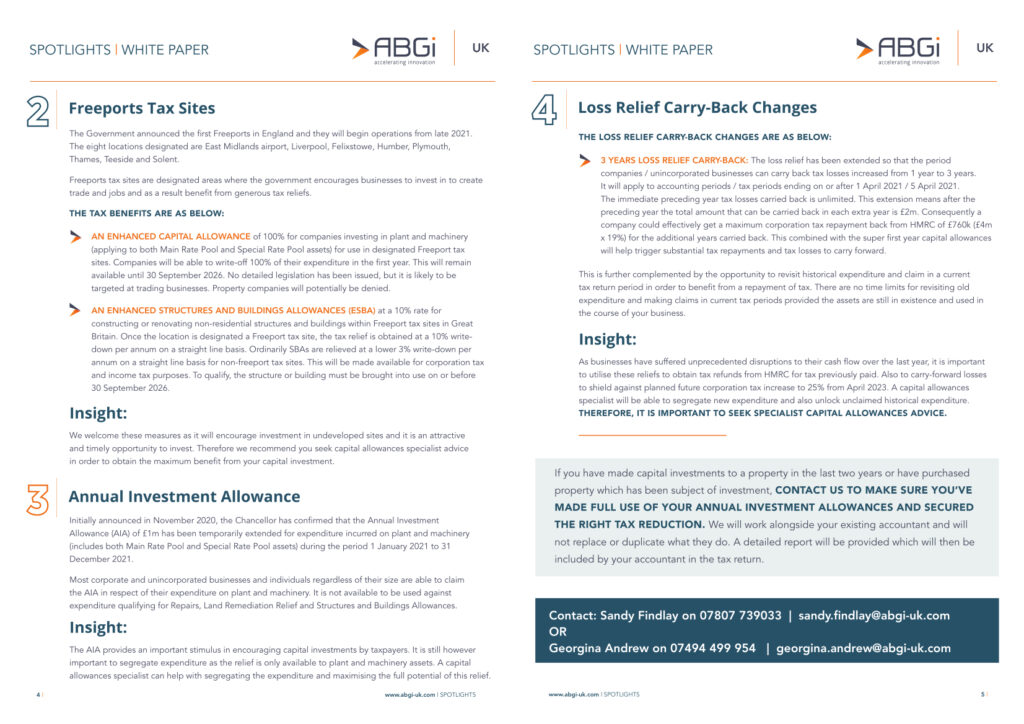

Summary of the changes made to the capital allowances scheme in 2021 budget.

Case study 1 – lack of expertise

In one such case, a company bought an office building for £5million. At the time the company’s tax adviser included an s198 tax election for £50K in the tax return, which was the only allowances claimed, even though the client asked the accountant for advice throughout the purchase, on the correct amount of tax allowances to be claimed in the tax return. Our capital allowances specialist contacted the company directly and identified that the seller could have claimed integral features on top of the s198 election as they were the first party to have bought the property since April 2008, when the current capital allowances regime came into effect.

As a result, the buyer missed extra allowances worth £400K. Furthermore, since the seller had incurred some refurbishment expenditure, he could have claimed additional plant allowances of £100K, and have transferred these along with £150K Structures and Buildings Allowances to the buyer. However, the seller refused to co-operate and consequently the buyer missed out on

an extra £650K of allowances.

Case Study 2 – lack of information

In another case, a company constructed a leisure facility for £4million and their accountant claimed allowances of £100K for heating works, based on invoices and records. No other allowances were claimed, and the accountant failed to alert the client to the poor quality of available cost breakdowns and invoice breakdowns for building works. Two years later the company was approached directly by a capital allowances specialist who identified an additional £1.5million of unclaimed allowances.

Unfortunately, these aren’t isolated cases. Over the last 6 months, we have been hearing increasing numbers of similar stories, and last month saw the establishment of the UK’s first business focussed on helping clients seek redress where accountants have failed to claim the full capital allowance relief available.

Many accountants and tax advisers recognise their limitation and will openly recommend and advise their clients to take specialist capital allowances advice when expenditure is significant or complex.

“The Blossom Moment”

If you have made capital investments to a property in the last two years or have purchased property which has been subject of investment, ABGI can help you make sure you’ve made full use of your Annual Investment Allowances and secured the right tax reduction. They will work alongside your existing accountant and will not replace or duplicate what they do. A detailed report will be provided which will then be included by your accountant in the tax return.

For more information on capital allowances and other innovation funding, check out ABGi GTM Global partner page here.

ABGI is a global consultancy with over 30 years’ experience helping some of the world’s best known brands accelerate innovation and business expansion by capitalising on their R&D activities, in compliance with all rules and regulations. They have extensive experience helping companies leverage valuable funding back into their business through government-backed incentives such as grant funding, R&D tax relief, Capital allowances or Patent Box.