For any high-growth and ambitious tech company in sectors like digital healthcare, smart IoT and eCommerce, 2021 is set to be a year of opportunity to expand domestically and go massive internationally.

There is plenty of evidence and appetite for growth and funding, as a series of recent studies and reports amply testify.

Based upon recent ONS data, there are some 33,860 UK scaleup businesses that represent £1 trillion to the UK economy. This is 50% of all SME turnover and (according to TECH NATION) makes the UK Europe’s top scaling nation with record investment of £10.1 billion, as demonstrated by having in 2019, 95 scale-up companies valued at £250-800 million – a 27% jump from 2018.

Furthermore, a recent report from Innovate Finance and the Scale-up Institute highlights the need to accelerate this growth in 2021 by a 5 point plan to creating a ‘National Blueprint for Growth’, accelerating the unlocking of Institutional and Corporate Funding, expanding the scale and reach of our National Development Banks, the role and scale of Innovate UK and in creating a Future Opportunity Fund.

Here are 7 ways to fund your business growth and international expansion in 2021, and to help you follow the money, GTM Global run an interactive webinar on 15 December connecting delegates to the experts, who are sign-posted in this article.

But first, some insights from Jeff Parker – WorldFirst’s CEO and one of the panellist at the GTM webinar – as he shares his views of the global opportunities and challenges that lie ahead in 2021.

“I think 2021 could be a very exciting opportunity for growth as post COVID world sees huge appetite and economic rebound. Some of the structural shifts we have seen will continue, for example, the shift to online and digital transformation, which impacts all related activities like supply chain and logistics.

Some of the traditional business models will rebound travel offline etc and with a number of businesses now bust, there will be opportunities for others to thrive.

I think you may see an acceleration of the recent reverse trend where online / tech businesses move offline to physical, as they leverage their cost structure and technology to do physical retail more effectively, for example Amazon stores.

There are likely to be good opportunities for SMEs to disrupt / take market share in these industries.”

Jeff Parker

CEO, WorldFirst (part of the Ant Finance Group)

7 Ways to Fund Your Business Growth and International Expansion in 2021

1. Equity Investment

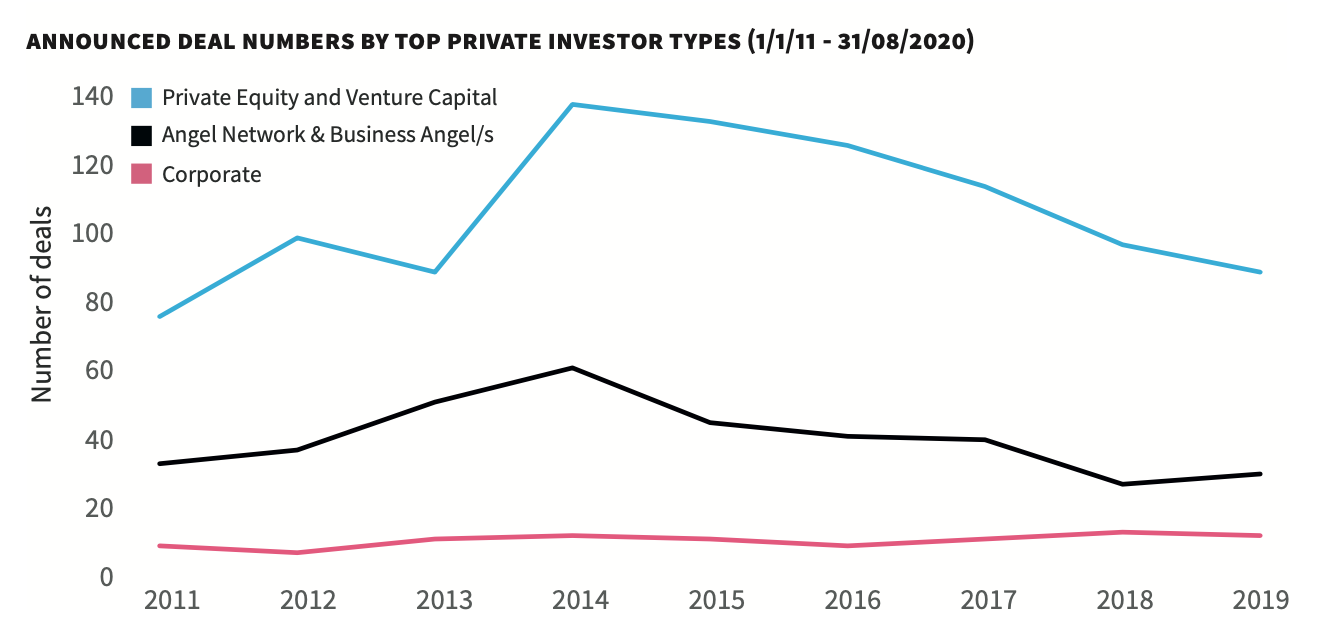

A recent report from Beauhurst and the Scaleup Institute, reveals that UK scaleups raised £5.32bn in equity in 2019, 1.6x more than the year before. In 2020 so far, the report shows £2.7bn has been invested into scaleups.

Private equity and VCs are by far leading investments into scaleups, with BGF Growth Capital the number one investor by number of deals and SoftBank in top place for amount invested at £1.85bn spread over 4 deals.

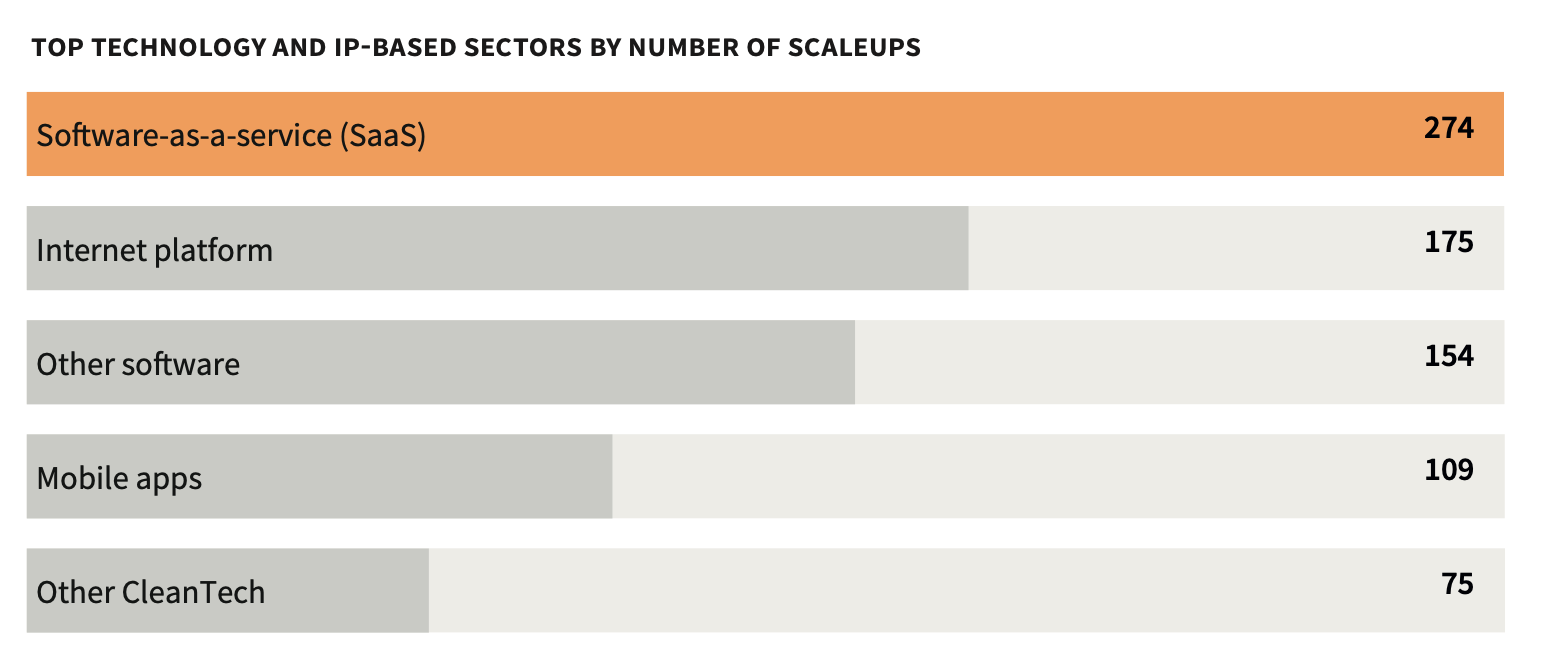

The report found that SaaS (software-as-a-service) companies lead the pack of tech scaleups:

According to Bearhurst, there are 327 active venture capital funds in the UK and in the US, according to the National Venture Capital Association, some 1,000 active firms.

Getting access to these VCs can be a complex affair, unless you are connected through your network. An alternative is to attend a pitch event, where you can meet a variety of investors in one hit. That’s the premise of GTM Global’s quarterly pitch event, where it aims to have 15+ VCs, family offices and private investors at each event. For more information and details of the next pitch event, visit our events page.

2. Debt Funding

Over the last several years, venture debt financing has grown in popularity among high-growth companies as a minimally dilutive form of growth capital.

It is often overlooked as a means of funding, but if you are going to raise institutional venture capital to build and grow your business, it’s worthwhile considering the use of venture debt to complement the equity you raise.

At GTM Global, we’ve been partnering with one of the world’s top debt-equity originations, Silicon Valley Bank, for over three years. The partnership gives our scale-up community access to venture debt from a global player in this space. To find out more and understand how venture-backed companies use venture debt, read this insightful article from SVB.

Or watch GTM’s funding webinar to hear directly from SVB’s James Downing, Director of Venture Capital Services.

James Downing

Director of Venture Capital Services, SVB

James is responsible for building relationships with institutional Venture Capital funds across Europe and the US, working with them on their portfolio companies and helping them to access SVB’s global platform.

Although debt equity is natural for venture-backed companies, it is available to both non-equity and equity-backed businesses, and beneficially, venture debt requires no board seats, no personal guarantees and minimal equity.

Best used for companies in the growth stage, traditional venture debt loans generally resemble a term loan with monthly interest payments and can last up to typically three years.

Another form of venture debt is revenue-based financing, which takes a percentage of monthly revenue as opposed to a fixed interest rate.

Specialist venture debt company, Flow Capital – based in Toronto, services the North American and UK markets, offering debt-based capital for tech, SaaS and other high-growth companies.

They are proponents of debt funding for multiple purposes, including performance insurance, funding for acquisitions or capital expenses, or to bridge to the next round of equity. To find out more, watch GTM’s free funding webinar when Kutral Veerabadran, one of the Principal’s at Capital Flow, gave practical tips and advice and shared examples of recent debt funding success stories.

3. Grants

We spoke to Ian Tracey, ex Head of Access to Funding & Finance at KTN (the UK Government’s Knowledge Transfer Network) about the grant landscape in the UK. As Ian explained “If you’re a UK-based business or research organisation, you may be able to compete for government-backed funding to research and develop a process, product or service, to test your innovation ideas or collaborate with other organisations.”

Administered by Innovate UK, support is available through grant funding, loans or procurements for various types of opportunities. These opportunities, which are run as competitions, are published regularly on the official Innovation Competitions portal.

Innovate UK also has dedicated funds and initiatives, such as the Industrial Strategy Challenge Fund, Knowledge Transfer Partnerships, Small Business Research Initiative and Innovation Loans. You can find out more about these and other initiatives here.

Ian Tracey

Co-Founder, AnchoredIn

Emma Fadlon

KTN Manager, Knowledge Transfer Network

David Golding

Head of North America & Global Networks, Innovate UK

But as Ian Tracey points out “Grant funding is often seen as “free money”, but that’s a misnomer – it is as free as securing a sale or equity investment. You need to put in effort into presenting the most compelling case, that your grant application is a better option than all the other applications that are being assessed.”

Ian knows this only too well. As CEO of Anchored In – an independent business that supports SMEs in need of funding or investment – he often has to explain the reality of this “free money”:

“Many of the questions that are asked by the grant application process are similar to the questions that investors or potential customers might be asking about your opportunity. As well as funding important R&D work, securing grant funding can provide validation of your project by a third party. This can be useful in the investment process to help investor confidence.”

Ian’s sage advice is to make sure that any project you propose is worth the effort it takes to put together a great grant application. “Compare the time required with seeking sales opportunities or other investment to further the project. By ensuring you only go for projects that are going to deliver real value to your company, you will not only be making best use of your time, but also putting forward the projects with the highest chance of success.”

Innovate UK also offer loans to support the innovation journey. These are typically for projects that are closer to market than the projects that grants are designed to support. They are available for projects with costs between £250,000 and £1.6m and based on technology that has received Innovate UK funding in the last 36 months. You can borrow in stages and will pay interest at 3.7% per annum on anything you borrow, with additional interest at 3.7% accrued and deferred until the repayment period. More details can be found here.

Ian shared his tips and advice alongside Emma Fadlon – Early Stage Investment Archangel at KTN, and David Golding – Head of North America & Global Networks at Innovate UK at GTM Global’s funding webinar on 15th December.

4. Business Loans

There are a raft of banks, commercial organisations and brokers offering access to a variety of business loans. We looked at a selection of these offerings to provide a summary below.

5. R&D Tax Credits

R&D tax credits are designed to encourage UK companies to invest in R&D aimed at advancing the baseline of science and technology and maintain the UK’s competitiveness in the global market.

As Sandy Findley from specialist innovation funding company ABGi explains,

“SMEs can claim up to 33p benefit for every £1 spent on qualifying R&D activities. The exact rate of relief you receive will depend on your Corporation Tax position and whether you are profit or loss-making.

Importantly, companies from EVERY industry sector can make a claim, from agriculture to life sciences to space industries, as long as you are addressing technical uncertainties you should consider claiming. Last year there were just over 52,000 claims from SME businesses in the UK, representing 25% of the limited SMEs in the UK.”

Sandy is also quick to point out that companies should be careful of the myths, including “you can only claim for successful projects”, “you can claim relief on all costs associated with an innovation project” OR “getting a grant means you can’t claim!”

To discover the truth about making a successful claim in under two working weeks, watch GTM funding webinar when Sandy shared his experiences and offered tips and advice to secure your R&D tax relief.

6. Patent Box

Companies which have been fortunate enough to develop intellectual property can use their IP to leverage additional funding back into their business.

We asked Sandy Findley at ABGi to describe the headline features of Patent Box ahead of his appearance at GTM’s funding webinar on 15 th December:

“Patent Box provides a reduced corporation tax of 10% on all profits directly associated with the commercialisation of a patent registered through the UK IPO or the EPO over the life of the patent. Companies holding medicinal and botanical rights or holding exclusive licences to third party patents may also benefit from the scheme. Last year, the average benefit received by claimants was £843,000 and with 96% of this going to large companies, there is still lots of scope for SMEs to take advantage of this scheme.”

Sandy Findley

Partnership Director, ABGI

For those companies with other forms of intellectual property, there are an increasing number of lenders willing to secure funding against IP valuations. Sandy touched on this at the funding webinar.

7. Investing NED’s & Fractional Execs

For many early stage businesses, the appointment of a non-exec director is not high on the agenda, not least of all from a cost and affordability perspective. There are some interesting, lower cost approaches to a regular appointment and two of those stand out for a mention here.

Roddy Cameron

Principal, Boardroom Advisors

Firstly, Boardroom Advisers. This business offers a pool of highly experienced Strategy/ Growth/ Product/ International Development Executives on a fractional basis and as their Principal, Roddy Cameron points out, “As a scale-up, your budget may not stretch to hire a full-time top-quality executive director to help you accelerate your growth. But at Boardroom Advisors, we plug the gap with an innovative and affordable approach.”

Roddy is clearly passionate about the opportunity and describes the key features “No recruitment fee, flat, affordable day rate, no long-term commitment, interchangeable personnel as your needs change, available from one day per quarter and almost immediately.”

Boardroom Advisors have built a national pool of the most experienced Advisors in the UK and are able to find the right match for a business’s needs and on the right terms.

Dermot Hill

Founder and CEO, Stakeholderz

The second business of note is Stakeholderz. We connected with Dermot Hill, founder and CEO of Stakeholderz, an innovative platform and service for accessing Board level talent and access to investment.

As Dermot explained, “Companies seeking to expand into international markets often need additional leadership expertise to achieve their objectives. A Non-Executive Director can be a highly cost efficient way to bring in the appropriate skills, experience and contacts -key to driving a business forward.“

And when it comes to investing NED’s Dermot elaborated, “An Investing Director, who can combine specialist expertise with personal investment, can significantly accelerate growth and importantly add credibility to attract investment from other sources.“

Both Roddy and Dermot were guest speakers at GTM’s funding webinar on the 15th December, when they told the full story behind investing NEDs and fractional execs!

To find out more about funding your business growth and international expansion in 2021, watch the interactive webinar, bringing together global business leaders, VC’s and alternative funders.

About GTM

GTM Global connects UK scale-up brands in digital and tech to a designated panel of experts from government, trade bodies and commercial partners to provide on-going advice and guidance on go-to-market strategy and international expansion planning.

By participating in the programme you can expect a mix of the following: